Do You Need Full Coverage on a Financed Car is a phrase which is more often than not used for vanity sakes, but it’s less so for their actual protective value. It is usually composed of three main parts: Car Insurance provides financial protection to the driver against damage caused due to accidents done by or on his/her vehicle.

Table of Contents

In short if these coverages work for other people and other people’s property, they also and foremost work for your property which is your car.

Full Coverage Car Insurance

Full coverage car insurance is car insurance which allows the driver to be shielded fully and without compromise. So, when people use the phrase ‘full coverage,’ they do not think of one particular policy, and when they say ‘insurance policy,’ they are definitely not talking about one policy which gives full coverage; instead, they mean the application of numerous insurance policies but it is not a full coverage.

For instance, full coverage can exclude uninsured motorist coverage, personal injury coverage or gap coverage, but this is provided you have taken it as an additional package.

What is Full Coverage Insurance?

1.Liability Insurance: In most States, this is a legal requirement and takes care of other persons’ injuries or property damage claims resulting from an accident you cause. It has two such types:

- Bodily Injury Liability – This type pays compensation which includes hospital bills incurred and loss of working incomes for the other driver and other passengers who got injured from an accident which you caused.

- Property Damage Liability – This type includes insurance for paying costs to fix or compensate 3rd party goods that were destroyed in an accident by the insured party.

2. Collision Coverage: assists to cater for the costs of damages on your car as a result of an auto accident, in this instance, no matter which was at default, to prevent putting one’s investment at risk within a car.

3. Comprehensive Coverage: This type is to pay for losses on the car that are not related to collision like when the car gets stolen, vandalized, attacked by a storm, flooded or when an object falls on the car from a building among other incidents.

Full coverage is a term that can be ambiguous provided the fact that no insurance will ever cover a hundred percent of the exposure. These three basic coverages your car is protected from most common risks.

Do You Need Full Coverage on a Financed Car?

The questions is Do You Need Full Coverage on a Financed Car? Full coverage is advantageous to the majority of car owners especially those who own new or financed cars because no matter how the accident occurs their cars are wrecked or totaled, they won’t be left to foot the bills of repairing their cars or replacing them.

I knew that full coverage meant any type of coverage, but when it comes to a car I’ve financed, I wanted to know for sure. If you are leasing or paying on your car you will more than likely need to have full coverage at the least. Creditors do not want to lose their interest in the car until you complete paying for the debt.

This means that the driver should have compulsory liability insurance as well as the collision and complete and comprehensive coverage.

The reasoning is simple: in case the financed car gets invades in an accident or stolen, or even a total loss when the borrower is still still repaying the loan, the financier would like to be assured that the car can be repaired or taken back and restored to its pre-accident state or replaced so as to recover the entire outstanding amount on the loan. This means that for any full coverage to occur, the lender’s investment is vulnerable to danger.

Do You Need Full Coverage on a Used Financed Car?

Indeed, a first party is normally needed on a used financed car as well. The same logic applies to used cars as it does to new cars: until you have an equity in the car, the financier has interest in making sure that the car is safe from harm, theft and any other related mishaps.

Thus, even if a car has become used and therefore costs considerably less than a brand new car, creditors demand both comprehensive and collision insurance so that their interest is safeguarded.

In the same way when a car is involved in an accident they must be in a position to ensure that the car can be salvaged or another one bought.

Minimum Full Coverage for Financed Car

The minimum full coverage for a financed car is property damage $30000, Bodily injury $100000 Both negligence and uninsured motorist $100000 and Medical payments $25000.

The minimum full coverage insurance for a financed car typically includes: The basic insurance limits that a financed automobile needs to be having are:

- Liability Insurance: This is Compulsory in almost all states and means the financial responsibility for harm to others or to others’ property in the event you are at Fault for an Accident.

- Collision Coverage: This will cover for the instance where you have to get your car back to its initial state after a damage through an accident regardless of the blame.

- Comprehensive Coverage: This saves your car from other mishaps that may not be as a result of an accident including theft, fire or disasters.

Sometimes the lender would also insist on gap insurance which is an automatic insurance that will pay out the balance of the amount that you still have to pay for the car and the actual cash value of the car in case of a total loss. Notably, it is worthy to understand that; gap insurance is not mandatory all the time.

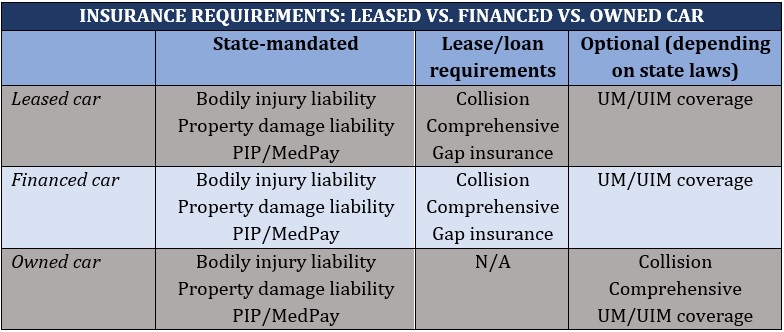

Financed Car Insurance Requirements

Insurance requirements for financed cars vary by lender, but typically, you’ll need: The laws governing the type of insurance to be taken differ depending on the financier; however, essentially, financed cars demand the following:

- Comprehensive coverage

- Collision coverage

- Car insurance (as is compulsory in the state)

In general, the lenders have to be sure that the car is always insured as it secures the loan amounts agreed upon. One of the requirements that some lending institutions request you to provide them with is proof of insurance so that you can use the car for a test drive.

Inadequate coverage may cause your lender to purchase force-placed insurance for you and this costs much and this type of insurance has less coverage than the usual insurance policy.

What Happens If You Don’t Have Full Coverage on a Financed Car?

If you fail to maintain full coverage on a financed car, several things could happen: If you do not ensure you keep comprehensive insurance on a financed car, several things might;

- Force-Placed Insurance: A lender’s insurance is insurance which is bought by the lender over the borrower. These are usually more costly than the normal insurance and serves only the interest of the lender, not you as the driver.

- Loan Default: Sometimes, if you do not make regular payments with a cover, you default in your loan and your car may be repossessed from you.

- Financial Risk: If your car is damaged or a total loss, with a basic policy, you may have to pay a lot of money yourself to get your car fixed or replaced.

Full coverage guarantees that both of you, the borrower and the lending company, will be safe against financial loss.

How Much Is Insurance on a Financed Car?

The cost of an insurance on a financed car depends on some certain parameters which include the make and the model of the car in question, your place of residence, your record as a driver and also the extent of coverage you want to be catered for by the insurance.

On an average, for financing a car fully and acquiring full coverage insurance, one has to spend from $1,200 to $2,000 every year in the region of the U. S. Remember always that automobiles with higher stated worth will usually attract higher insurance premium rates, those with higher theft rates or those that are more expensive to repair.

Moreover if you opt for extras such as gap insurance or personal injury or uninsured motorist protection, then your premiums will rise.

Factors That Impact the Cost of Full Coverage on a Financed Car

The cost of full coverage varies widely depending on a range of factors: The cost of full coverage varies widely depending on a range of factors:

- Type of vehicle: In other words, the cost of insurance premiums reflects some aspects of car ownership – for instance, cars that are costly to repair or Clamp Institute’s cars that are more likely to get stolen require higher premium amounts. Sports or luxury cars might cost more for insurance than the usual cars.

- Driving history: If the driver participated in accidents, violations, claims, his/her tariffs will be increased.

- Location: It is evident that insurance rates vary with region. Some of the factors include the number of accidents in the area, or the likelihood of theft, among others; the higher the rate, the higher the premium.

- Credit score: Most companies use credit ratings to set your premiums and this is notable in some of the states. One might be eligible for a reduced premium if he or she has a higher credit rating.

- Mileage: The cost of full coverage also depends on the mileage that you put in your car, and this includes how frequently you use your car. You get the impression that drivers who cover many miles daily in their car may be charged higher than the few who may drive only to and from work and back home.

Can You Remove Insurance on a Financed Car?

Besides, you cannot be able to remove insurance on a financed car. The full coverage means that the interest of the lender of the automobile is protected until the loan has been repaid. If you cancel the insurance or fail to renew it, the lender will take an action, for example, put forced placing insurance on the car or repossess it.

Once you pay off the loan completely, you can decide to self dismiss your comprehensive and collision coverage but this is not wise especially if your car is of very low value. When you don’t have full coverage, you will be on your own to source for the money needed to repair or replace the damaged goods in case of an accident or any form of destruction.

What to Consider When Financing a Car

Just as any other loan, car financing comes with compulsions to insurance and this is for the protection of both the financier and the financee. It’s important to keep in mind:

- The major requirement that is usually demanded by the lenders is an insurance proof on the car before it is released for use.

- If you are unable to avail proof of full coverage, the lender tends to buy force-placed insurance which costs a lot higher than if you were to look for it by yourself.

- Force-placed insurance mainly covers the lender’s interest and it may not be the full coverage sometimes.

Conclusion

Across the country, it is mandatory to have an insurance cover that fully covers your car particularly where the car is on a finance. This makes combined liability, collision and comprehensive insurance guarantee the lender and you in case of an accident, theft or any other harm to the car. It is required for anyone getting a car loan to have full coverage and to not maintain it can lead to expensive penalties including force-place insurance or even loss of a car loan.

Although full coverage may cost more than the liability-only, it gives you a guarantee that you will not pay for the expenses incurred on the car in case of an accident. If you own a new or a used car, it is recommended that the car be fully insured until the client feels that he has an outright ownership in the car where one can then review whether to fully insure the car or not.

Thus, having learned about full coverage insurance requirements and its relevance, you will be able to make correct decisions that will secure your vehicle and your wallet.